What You Need to Know About Buyouts

A buyout can be the answer for many flood-affected homeowners

While flooding impacts nearly every county in America, some counties’ flood problems are so severe that their residents have no choice but to leave their homes and move elsewhere. When other flood solutions won’t solve the problem, buyouts give residents a fresh start and allow counties to focus on protecting the homes that can be saved.

The Takeaway

Buyouts are the only solution for many flood-prone properties. Voluntarily opting into a program that pays fair market value for an otherwise difficult-to-sell property is a must-have option for these property owners. But buyouts don’t only benefit them. Buyouts also benefit their neighbors and the county when used correctly. Converting a flood-prone property into open space or a plot of land for flood prevention helps neighbors avoid financial loss and helps lessen the amount of disaster relief needed for the county.

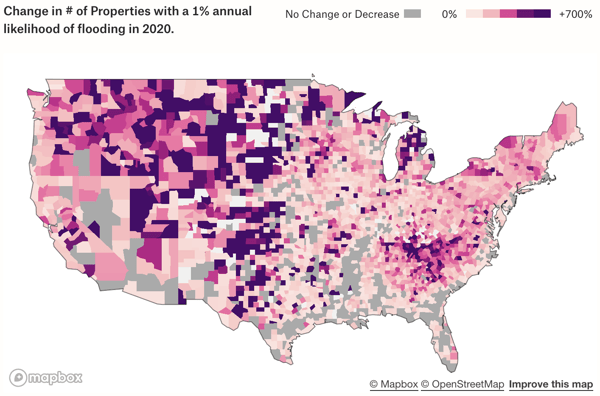

The problem: Thousands of US homes have so much flood risk that flood protection would either cost an unreasonable amount or feasible solutions don’t exist. Some of these homes were knowingly built in risky locations, but builders and local governments developed anyway. Other homes appeared to be in safe locations based on outdated maps from the Federal Emergency Management Agency (FEMA) but really were not.

-

Go deeper: FEMA’s maps are often outdated, imprecise, and incomplete. Newer maps produced by the non-profit organization First Street Foundation show true flood risk for every property in America. Unlike FEMA’s maps, these maps factor in flooding from rainfall, the effects of adaptation measures, and expected changes in sea level and storm intensity.

-

Yes, and: Homes built in at-risk locations but listed outside FEMA’s flood maps make up the largest group of properties that need buyouts.

Taxpayers end up stuck with the bill for these high-risk homes. The tax dollars of citizens across the US cover repeated payouts from the National Flood Insurance Program (NIFP), and local residents fund the emergency services needed to rescue people from high-risk homes during flood events. Also, residents in high-risk homes are stuck flooding again and again — a fate that nobody wants to endure year after year.

The solution: Aside from the costly and drastic process of home elevation, buyouts are the clear fix for these high-risk cases. Buyouts provide homeowners in flood-prone areas with a voluntary opportunity to sell to the local government at fair market value.

-

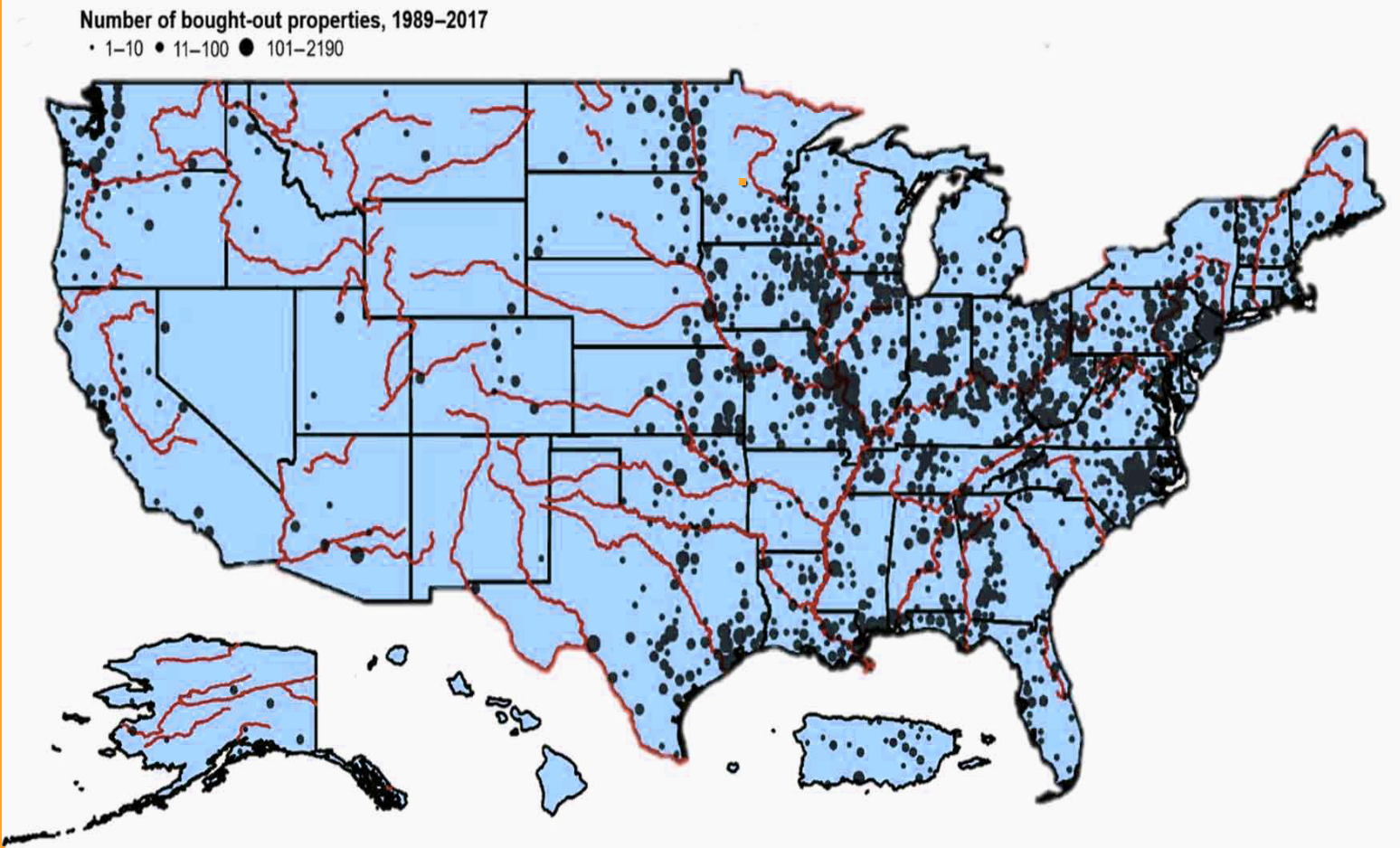

Why you need buyouts: More than 40,000 homeowners have received a buyout in the last 4 decades. While it may feel like a last resort for some, recouping value for a house that has and will continue to flood protects homeowners from losing a lot of value when they inevitably have to move. Selling a flood-risk home is not easy, but buyouts give sellers a guaranteed buyer.

-

Why your county needs buyouts: Buyouts might sound like a losing proposition for the county, but the exchange favors both sides. The county can remove the house and convert the lot to open space. That open space makes more room for water when it floods, helping to protect the rest of the community. Additionally, upfront investments in buyouts can free taxpayers of big flood rescue and recovery costs later on.

Yes, but: Buyouts today suffer from three challenging but surmountable problems:

-

They are slow and take more than 5 years on average to complete.

-

They are inflexible, funded by the federal government only in very specific circumstances, and based on outdated federal maps.

-

They are reactive, almost always coming after a disaster, not before one.

The big picture: Counties can set up their own programs that fund buyouts and avoid the usual problems.

-

They can bypass slow federal government programs, and buy flood-prone homes in as little as six months, rather than ~4.5 years.

-

They can buy at will, regardless of what the federal maps say.

-

They can work ahead of time, by identifying places with outsized risk and addressing it without waiting for a storm to hit.

Take action: Flood-prone residents could ask their county for personal buyouts, but they might get rejected. Local governments often use funding as an excuse to sidestep responsibility and pass on buyout programs. But there are creative ways for counties to secure funding for these valuable programs.

Any of these three funding sources can be leveraged to help counties develop their own buyout programs that provide high-risk residents with a solution while avoiding the challenges with federal government programs.